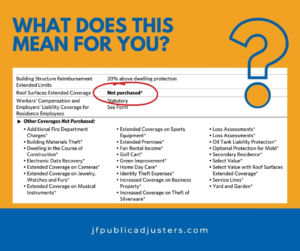

AllState Insurance’s Roof Surfaces Extended Coverage is an optional add-on that homeowners can choose to include in their insurance policies. This coverage helps to protect your roof from damages caused by natural wear and tear, as well as storms, wind, or hail. Without this extended coverage, the compensation a homeowner would receive for roof damage may be based on the roof’s actual cash value (ACV), which takes depreciation into account. Essentially, the older your roof is, the less compensation you’ll receive in the event of a claim, as the roof’s value will have diminished over time.

For example, if your roof is 20 years old and you experience storm damage, the standard AllState policy without Roof Surfaces Extended Coverage would settle the claim based on the depreciated value of the roof.

Since a roof typically has a life expectancy of 20-30 years, your roof’s current value would be much lower than its replacement cost. This means that your claim payout might only cover a fraction of the cost to repair or replace your roof, leaving you with a significant out-of-pocket expense.

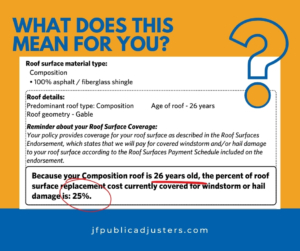

Let’s look at the example below:

In this example,since the roof is 26 years old, in the event of storm damage, the standard AllState policy without Roof Surfaces Extended Coverage would settle the roof replacement portion of the claim based on:

25% – insurance coverage

75% – homeowner’s share

To make it even clearer, if the Replacement Value of the roof is $30,000:

$7,500 – insurance coverage

$22,500 – homeowner’s share

However, with Roof Surfaces Extended Coverage, AllState would compensate you based on the full replacement cost of the roof, regardless of its age, ensuring that you’re not left with a hefty bill after a disaster.

A word of caution, though, we have worked with several clients with Allstate policies and most, if not all, of them did not have take the Roof Surfaces Extended Coverage which greatly impacted their claim settlement.

At JF Public Adjusters, we share this information to help the general public make informed decisions about the type of insurance policies they take out.

Understanding your coverage and the terms that could impact your claim settlement is critical to avoid surprises when disaster strikes.

Even if you’re insured with other companies, we encourage you to review your policy thoroughly to ensure that you have adequate protection for your roof and other important aspects of your home.

We’re here to help homeowners navigate these complexities, ensuring they get the settlements they deserve when filing insurance claims.

GET IN TOUCH!

The Leading Property Damage Experts Are Here To Help

CONTACT NEW YORK’S HIGHEST RATED PUBLIC ADJUSTER IMMEDIATELY BY CALLING OUR OFFICE OR BY COMPLETING THE FORM.

CALL US FOR FREE