Public Adjuster for Water Damage Claims in New Paltz, New York

Water damage can cause significant destruction to your property, leading to costly repairs and potential health hazards. At JF Public Adjusters, we specialize in navigating the complexities of water damage claims to ensure you receive the maximum compensation you deserve. Our experienced team is dedicated to advocating for your rights, meticulously documenting damage, and negotiating with insurance companies on your behalf. Trust us to handle your water damage claim with expertise and care, helping you restore your property and peace of mind.

The Common Causes of Water Damage

BURST OR LEAKING PIPES

WATER HEATER LEAKS

APPLIANCE LEAKS

ROOF LEAKS

SUMP PUMP BACK UP

HVAC LEAKS

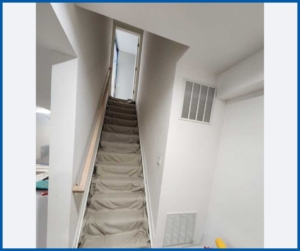

Filing a claim for water damage to your New Paltz, NY home or business?

Don’t let you insurance company push you around. JF Public Adjusters advocate for your rights, securing you the settlement that you’re entitled to. Contact us today for a free consultation and on-site inspection.

Level the Playing Field

Partner With The Property Damage and Insurance Claim Experts

Frequently Asked Questions About Water Damage and Water Damage Insurance Claims

GET IN TOUCH!

The Leading Property Damage Experts Are Here To Help

CONTACT NEW YORK’S HIGHEST RATED PUBLIC ADJUSTER IMMEDIATELY BY CALLING OUR OFFICE OR BY COMPLETING THE FORM.

CALL US FOR FREE