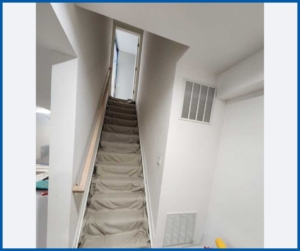

Public Adjuster for Basement Flood Damage Claims in Queens

Homeowners frequently come to us reporting that their basement has flooded. Basement flooding can be caused by a variety of factors, and understanding the source is crucial as this determines whether or not we can assist.

At JF Public Adjusters, we specialize in helping homeowners navigate these complex situations. Once we have determined that the damage is covered by an insurance policy, our experienced team will assess the damage, document all losses, and work diligently with your insurance provider to ensure you receive the necessary compensation to repair and restore your basement. Trust JF Public Adjusters to handle your claim with expertise and care, allowing you to focus on getting your home back to normal.

What is The Cause of the Flooding in Your Basement?

Burst Pipes

Pipes can burst due to freezing temperatures, high water pressure, or age-related wear and tear.

Usually covered by standard homeowners insurance if the burst is sudden and accidental.

Appliance Failure

Appliances such as water heaters, washing machines, or sump pumps can fail, leading to water overflow.

Typically covered if the failure is sudden and accidental.

Heavy Rainfall

Excessive rain can overwhelm drainage systems, leading to water seeping into the basement.

Covered only if the homeowner has a specific flood insurance policy; not covered under standard homeowners insurance.

Sewer Backups

Blockages or overflows in the sewer system can cause water to back up into the basement.

Often not covered by standard policies unless a specific sewer backup endorsement is purchased.

Foundation Cracks

Cracks in the foundation can allow groundwater to seep into the basement.

Generally not covered, as this is considered a maintenance issue.

Clogged Gutters and Downspouts

When gutters and downspouts are clogged, water can overflow and pool around the foundation, eventually seeping into the basement.

Not typically covered, as this is seen as a preventable maintenance issue.

Poor Drainage

Improper grading or inadequate drainage systems around the home can cause water to pool and seep into the basement.

Usually not covered, as it is considered a maintenance issue.

Broken Sump Pump

If a sump pump fails, it can no longer remove water from the basement effectively, leading to flooding.

Typically covered if the failure is sudden and accidental, but not if it is due to a lack of maintenance.

Natural Disasters

Extreme weather events such as hurricanes and storm surges can cause widespread flooding.

Covered only if the homeowner has a flood insurance policy; not covered under standard homeowners insurance.

Window Well Flooding

Water can collect in window wells during heavy rains and seep into the basement through windows.

Generally not covered unless the damage results from a covered peril.

Leaking Water Supply Lines

Supply lines can leak due to corrosion, age, or sudden damage, causing water to pool in the basement.

Usually covered if the leak is sudden and accidental.

Groundwater Seepage

High groundwater levels can seep into the basement through walls and floors.

Generally not covered, as it is considered a maintenance issue.

Insurance Considerations:

Standard Homeowners Insurance: Typically covers sudden and accidental water damage, such as from burst pipes or appliance failures.

Flood Insurance: Required for coverage of flooding due to natural disasters or excessive rain. This must be purchased as a separate policy through the National Flood Insurance Program (NFIP) or private insurers.

Endorsements and Riders: Additional coverage for sewer backups or sump pump failures can often be added to standard policies through endorsements or riders.

Understanding the source of basement flooding is crucial for determining whether insurance will cover the damage. Homeowners should regularly inspect and maintain their property to mitigate risks and ensure they have appropriate coverage for potential flooding events.

Filing a claim for basement damage to your Queens home or business?

Don’t let you insurance company push you around. JF Public Adjusters advocate for your rights, securing you the settlement that you’re entitled to. Contact us today for a free consultation and on-site inspection.

Level the Playing Field

Partner With The Property Damage and Insurance Claim Experts

Frequently Asked Questions About Basement Flooding and Basement Damage Claims

Dealing with basement flooding can be stressful, but understanding your insurance coverage and knowing the steps to take can make the process smoother. At JF Public Adjusters, we are dedicated to helping homeowners navigate the complexities of basement flooding claims, ensuring you receive the compensation you deserve. If you have any questions or need assistance, don’t hesitate to contact us.

GET IN TOUCH!

The Leading Property Damage Experts Are Here To Help

CONTACT NEW YORK’S HIGHEST RATED PUBLIC ADJUSTER IMMEDIATELY BY CALLING OUR OFFICE OR BY COMPLETING THE FORM.

CALL US FOR FREE