Understanding when your homeowners insurance covers roof replacements can save you from unexpected expenses and stress. Often overlooked until trouble arises, your roof is a vital component of your home’s structure, shielding you from the elements. Yet, it’s vulnerable to various damages, whether from severe weather conditions, fallen trees, leaks, or wear and tear over time.

When it comes to addressing roof damages, many homeowners wonder if their insurance policy will foot the bill for a replacement. The answer isn’t always straightforward, as coverage depends on the specific circumstances surrounding the damage. While homeowners insurance typically covers the structure of your home, including the roof, certain conditions must be met for an insurance claim to be approved.

Homeowners insurance covers roof replacements when damages result from acts of nature or sudden accidents. For instance, if a tree falls on your roof during a storm, your insurance policy will likely cover the costs of repair or replacement. However, damages due to general wear and tear or lack of maintenance are typically considered the homeowner’s responsibility and are not eligible for reimbursement.

The top 3insurance claim events that commonly cause damage to the roof include:

It’s essential to review your policy to understand the extent of your coverage and the types of damages included. While most insurance policies follow the general rule of covering damages from sudden accidents or natural disasters, it’s wise to confirm with your insurance provider to avoid any surprises when filing a claim.

When initiating a roof replacement claim, it’s crucial to document the damages thoroughly. Take multiple photos from various angles, record the date and cause of the damage, and keep detailed records of all communications with your insurance company. This documentation will strengthen your claim and increase the likelihood of a favorable outcome.

Once you’ve determined that your insurance policy covers the damages, the next step is to file a claim promptly. Familiarize yourself with your insurer’s claim submission process and adhere to any deadlines to avoid potential claim denials.

After filing your claim, consider hiring a reputable roofing company to assess the damages and provide a detailed report. While your insurance company may send out an inspector, having an independent assessment can bolster your case and ensure that all damages are accurately documented.

Navigating the insurance claim process can be daunting, especially when dealing with large insurance companies. If you encounter challenges or feel overwhelmed, don’t hesitate to seek assistance from a public adjuster or claims expert. These professionals can advocate on your behalf, ensuring that you receive fair compensation for your roof replacement.

At JF Public Adjusters, we specialize in maximizing insurance claim settlements for homeowners facing roof damages. Our team of experienced adjusters will guide you through the claims process, from initial assessment to final settlement, ensuring that your interests are protected every step of the way.

Understanding when your homeowners insurance covers roof replacements is essential for mitigating financial burdens and securing your home’s integrity. By familiarizing yourself with your policy, documenting damages, and seeking professional assistance when needed, you can navigate the claims process with confidence and ensure that your roof replacement is handled promptly and fairly.

The Roof Insurance Claim Process

Managing a homeowners insurance claim for roof damage might be difficult, however you can make sure that your damages are compensated swiftly and equitably by taking the appropriate steps. Here’s how to file a roof claim on your homes insurance step-by-step:

The Top Residential Damage Adjusters in New York Provide Their Expert Advice on 5 Telltale Signs You May Have a Roof Leak

Unlike other parts of the house that get accessed regularly, roofs are almost always forgotten until something happens. This is why roof leaks usually go undiscovered until they inflict serious harm.

We’ve put up a list of the top five indicators to look out for in order to assist homeowners like you in spotting any roof leaks early on. These observations are based on the many water damage claims that we have managed throughout New York, New Jersey, Connecticut and Pennsylvania

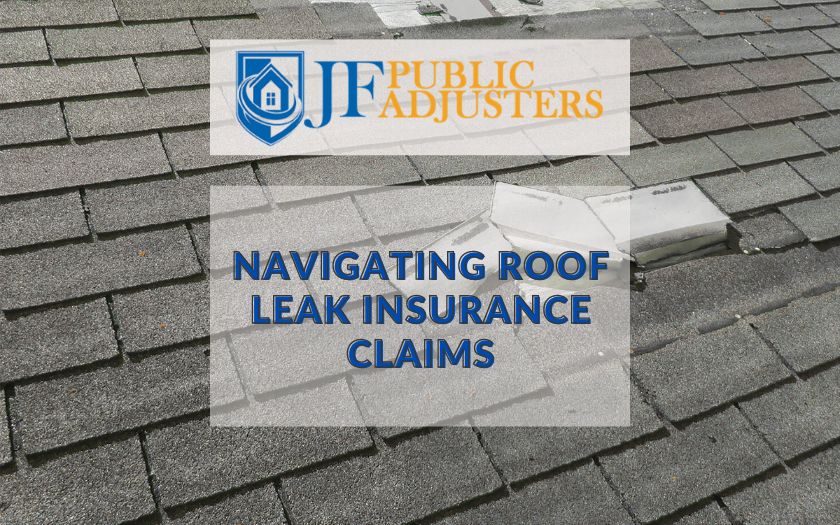

1. Missing tiles or shingles

Missing shingles or tiles is one of the most frequent reasons of roof leaks. These roof gaps give water easy access locations, which can result in leaks and subsequent water damage. Make sure to check your roof after a storm for any indications of missing or damaged shingles. Don’t hesitate to get in touch with JF Public Adjusters if you see any problems so we can help you with your water damage claim.

2. Blocked Drains

Water must be directed away from your roof and house via gutters. However water can clog gutters with leaves and twigs, which can stop the water from flowing freely and cause it to pool on your roof. Water damage may result from this standing water eventually seeping into your house. Maintain good drainage and avoid obstructions in your gutters by cleaning them on a regular basis and after strong winds if your home is surrounded by trees.

3. Attic Condensation

An obvious indicator of a roof leak may be an abundance of humidity in your attic. If water leaks through your roof, it could collect in the attic and cause condensation on ceilings and walls. To stop additional damage, you must take immediate action if you find moisture or condensation in your attic.

4. Debris Accumulation

Debris accumulation on your roof can happen during intense downpours. Over time, debris such as twigs, branches, leaves, and other items can build up, stressing your roof and possibly providing openings for water to enter. To avoid water damage, get your roof inspected on a regular basis and clear any debris.

5. Discolorations from Water

Water stains on your walls or ceiling are a dead giveaway that your roof is leaking. Water that seeps through your roof may descend into your house and stain the interior surfaces. It’s critical to treat the underlying roof leak as soon as you see water stains in order to stop additional damage. For professional help with your water damage claim and to make sure you get reimbursed fairly for repairs, get in touch with JF Public Adjusters.

Homeowners may reduce the chance of water damage to their houses and solve problems early on by being watchful and identifying these indicators of a roof leak. Do not hesitate to contact JF Public Adjusters for professional assistance with your insurance claim if you believe you have water damage or a leaky roof. We are available to assist you in navigating the claims procedure and making sure you get paid fairly for the repairs you need to have done due to water damage.

GET IN TOUCH!

The Leading Property Damage Experts Are Here To Help

CONTACT NEW YORK’S HIGHEST RATED PUBLIC ADJUSTER IMMEDIATELY BY CALLING OUR OFFICE OR BY COMPLETING THE FORM.

CALL US FOR FREE