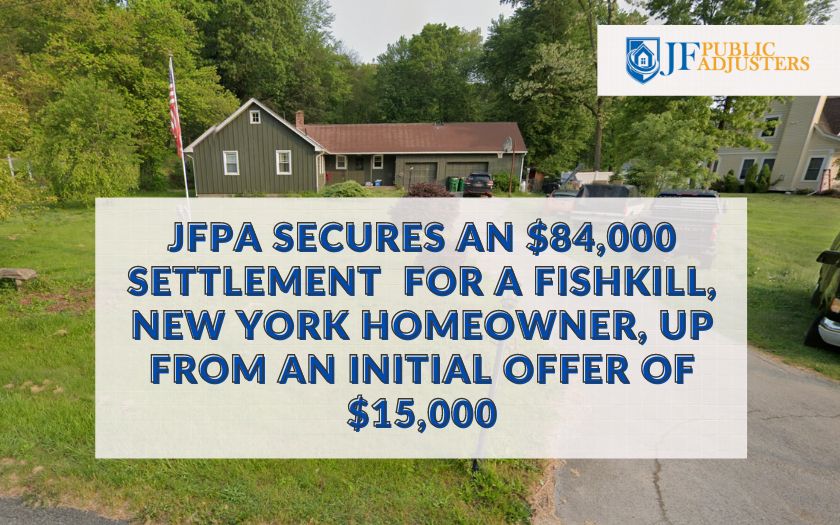

Situated amid the lush vegetation of Fishkill, New York, a resident encountered a formidable foe in the form of water damage. A routine day descended into a living nightmare when the homeowner discovered infiltration of water, which caused damage to their residence. Recognizing their need to rely on an expert to help them through this process, they sought the counsel and knowledge of JF Public Adjusters in order to successfully navigate the intricate landscape of claims.

The majority of the water’s destructive impact was sustained by the roof, the kitchen right below it and the main bedroom. The water damage extended, albeit to a lesser extent, to other areas of the property namely the hallways, two other bedrooms and the living room.

After the mitigation company provided documentation and evidence of the damage to the insurance company, the insurance company made a settlement offer to our client via our office, as follows:

Replacement Cash Value: $15,200

Recoverable Depreciation: $5,400

Immediately, we knew that this offer was significantly less than the amount required to fully repair the damages. JF Public Adjusters, undeterred by this initial setback, declined the offer.

The dispute centered on the state of the roof, which had been severely damaged by the inexorable forces of the elements. In light of the irreparable shingles and the unavailability of appropriate commercially-available alternatives, JF Public Adjusters expressed that a comprehensive roof replacement was essential.

In an effort to provide insight into the extent of the damage, the insurance company instructed one of their vendors to perform a Brittle Test on the shingles. Unsurprisingly, the test outcomes corroborated the viewpoints articulated by JF Public Adjusters. The vendor’s report stated:

“…The sample evaluated has color features that are no longer available.There are no products on the current market with a color that would be considered similar.”

This confirmed the necessity for a complete roof replacement.

The insurance company, equipped with the results of the Brittle Test, made a revision to their settlement offer, as follows:

Replacement Cash Value: $28,168.65

Recoverable Depreciation: $10,421.35

However, even this offer was insufficient to replace the roof, let alone repair the damage to the other areas of the home. JF Public Adjusters unequivocally declined the offer once again.

The insurance company expressed they would not be able to entertain any further increases to the offer prior to an inspection of the property. The JFPA team arranged an onsite inspection to show the insurance company’s adjuster the true extent of the damage – the damage that we had provided an estimate for.

Not long after the inspection, the insurance company returned with the final offer as outlined below.

Replacement Cash Value: $51,071.01

Recoverable Depreciation: $11,035.18

Although this RCV was already significantly higher at 240% more than what the insurance company initially offered to settle the claim for, we knew this would not be enough to cover the true cost of the repairs.

JFPA made further attempts to convince the insurance company to increase the settlement, however the insurance company remained firm and expressed that this was their final offer.

With negotiations having come to a stalemate, JFPA discussed escalation options with the client, recommending that we take this claim into appraisal. We discussed the appraisal process with the homeowner, ensuring they are aware of the estimated timeframe for this process and what it entails. The client accepted our proposition and the claim went into appraisal.

As expected, we did achieve favorable results through the Appraisal process with the settlement increasing by a further $33,000 from the last offer. The final settlement on this claim came to:

Replacement Cash Value: $84,021.93

Recoverable Depreciation: $8,788.11

Upon receiving the final settlement, the homeowner exhaled a murmur of relief, realizing that they could commence the process of rebuilding. Equipped with the financial resources to conduct a thorough roof replacement and repair the remaining damage, they eagerly anticipated reclaiming their haven and resuming their daily lives.

The narrative of the Fishkill householder serves as a testament to the benefits of hiring a public adjuster and choosing one that will fiercely advocate for what you are entitled to. JF Public Adjusters maintains a steadfast dedication to the cause of our clients.

GET IN TOUCH!

The Leading Property Damage Experts Are Here To Help

CONTACT NEW YORK’S HIGHEST RATED PUBLIC ADJUSTER IMMEDIATELY BY CALLING OUR OFFICE OR BY COMPLETING THE FORM.

CALL US FOR FREE