Homeowners’ insurance is a valuable safeguard, providing financial protection against a wide range of property damage events. In this article, we will explore two crucial aspects of property insurance in New York. First, we will delve into the types of property damage typically covered by homeowners’ insurance. Then, we will guide you through the initial steps of filing a property insurance claim in the Empire State. Additionally, we’ll touch upon the invaluable role of public adjusters, like JF Public Adjusters, in simplifying and maximizing your insurance claim experience.

But before we get into those, let’s do a recap of the 4 primary types of coverage provided in a standard homeowners’ insurance policy.

1. Coverage for Your Home’s Structure: If your home is damaged or destroyed by events like fire, hurricanes, hail, or lightning, your homeowners policy will cover the costs of repair or reconstruction. This coverage typically extends to detached structures like garages or sheds, usually at about 10% of your home’s insured value.

Note: Standard policies do not cover flood or earthquake damage or regular wear and tear.

It’s essential to ensure your coverage is sufficient to rebuild your home completely.

2. Coverage for Personal Belongings: Your policy includes coverage for personal items such as furniture, clothing, sports equipment, and more. If these items are stolen or damaged due to covered disasters, the insurance typically covers 50% to 70% of your home’s insured value.

It’s advisable to assess whether this coverage amount is adequate by conducting a home inventory.

Personal belongings coverage extends worldwide and usually includes up to $500 for unauthorized credit card use. High-value items like jewelry or art may require special endorsements to ensure full coverage based on their appraised values.

3. Liability Protection: Homeowners insurance also provides liability coverage, protecting you from lawsuits related to bodily injury or property damage caused by you, your family members, or even your pets to others. This coverage not only pays for legal defense but also court-awarded damages, up to the policy’s stated limit. While liability limits typically begin around $100,000, it’s prudent to discuss higher coverage levels with your insurance professional if you have significant assets. For increased protection, you can consider an umbrella or excess liability policy.

4. Additional Living Expenses (ALE): ALE coverage reimburses you for extra living expenses if you cannot reside in your home due to damage from a covered disaster. This includes costs like hotel stays, restaurant meals, and other expenses incurred beyond your usual living costs while your home is being repaired or rebuilt.

ALE coverage has limits and, in some cases, time restrictions, but it is separate from the funds available for home repair or reconstruction. If you rent out part of your home, ALE can also cover the rent you would have collected from your tenant if your home had not been damaged.

Now let’s get to the main topic of this blog post:

Part 1: Types of Property Damage Covered by Homeowners’ Insurance in New York

Homeowners’ insurance policies in New York typically cover a variety of property damage events, including:

1. Fire and Smoke Damage: If your home or belongings are damaged due to a fire or smoke, homeowners’ insurance typically provides coverage. This includes damage from wildfires, kitchen fires, electrical fires, and smoke-related issues.

2. Water Damage: Homeowners’ insurance often covers water damage caused by sudden and accidental events, such as burst pipes, plumbing leaks, and appliance malfunctions. However, damage from flooding usually requires a separate flood insurance policy.

3. Wind and Hail Damage: Damage caused by windstorms and hail is typically covered by homeowners’ insurance. This includes damage to your roof, siding, windows, and personal property.

4. Theft and Vandalism: If your home is burglarized, or your property is vandalized, homeowners’ insurance can provide coverage for stolen items and repairs to damaged property

5. Falling Objects: Damage resulting from falling objects like trees or debris is often covered. Your policy may also cover removal costs for fallen trees.

6. Liability: Homeowners’ insurance includes liability coverage, protecting you if someone is injured on your property and you are found responsible. It can also cover legal expenses.

It’s essential to review your specific policy to understand the extent of coverage and any limitations or exclusions that may apply.

Part 2: Starting the Property Insurance Claim Process in New York

When faced with property damage, follow these steps to initiate the insurance claim process:

1. Prioritize Safety: Ensure everyone’s safety and well-being. If there are immediate dangers like fires or structural issues, contact emergency services.

2. Document the Damage: Take clear photos and videos of the damage. This visual evidence will be invaluable when filing your insurance claim.

3. Contact Your Insurance Company: Notify your insurance company as soon as possible. Provide them with basic information about the incident and the extent of the damage. Be prepared to give your policy number and other relevant details.

4. Mitigate Further Damage: Take reasonable steps to prevent additional damage to your property. This might involve shutting off utilities, securing the premises, or making temporary repairs. Keep all receipts for these emergency measures, as they may be reimbursed by your insurance company.

5. Consult a Public Adjuster: Consider enlisting the assistance of a public adjuster, such as JF Public Adjusters, to streamline and optimize your claims process. Public adjusters are experts in assessing damage, preparing comprehensive claims, and negotiating with insurance companies on your behalf. They save you time, reduce stress, and ensure you receive a fair settlement for your losses.

Homeowners’ insurance in New York provides crucial protection against various property damage events. Understanding your policy’s coverage is essential to ensure you’re adequately protected. When property damage occurs, following the proper steps to initiate a claim is vital. Additionally, public adjusters like JF Public Adjusters can be your trusted partners in navigating the complex claims process, ensuring that you receive the compensation you deserve while minimizing the associated stress and hassle. Don’t hesitate to seek their expertise when you need it most.

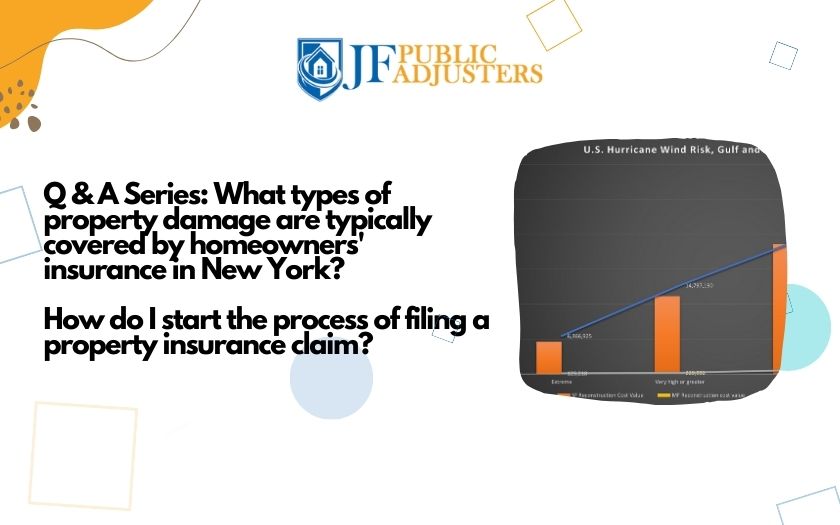

We also share with you some recent statistics and forecasting data, in particular:

1. U.S. Hurricane Wind Risk, Gulf and Atlantic States, 2023

2. Top 5 Metropolitan Areas At Risk for Storm Surge and Hurricane Wind, 2023

Note for both:

Single Family/SF – Residential structures less than four stories, including mobile homes, duplexes, manufactured homes and cabins.

Multi-Family/MF – Apartments, condominiums and multi-unit dwellings.

The risk categories are cumulative and increase in value from extreme to moderate or greater. The moderate or greater wind risk level encompasses all four wind risk levels.

Claim cost combines materials, equipment and labor, but does not include the value of the land or lot.

Source: CoreLogic®, a property data and analytics company.

Data obtained from https://www.iii.org/fact-statistic/facts-statistics-hurricanes

If your property experiences damage from a covered event, such as a fire or broken pipes, or roof issues caused by a windstorm or tornado, please reach out to us. We’d be delighted to have a conversation about how we can assist you.

Our mission is to guide policyholders through the process of managing their water damage insurance claims, ensuring they secure the most favorable settlement. Our aim is to swiftly and efficiently restore your home to its pre-loss condition.

Uncertain about whether your insurance will provide coverage for the damage? We encourage you to get in touch with us regardless. JF Public Adjusters offers a complimentary review of your claim and a consultation. You can reach us via phone or text at (917) 272-8793.

Contact Us

You can reach us via phone or text at (917) 272-8793.

GET IN TOUCH!

The Leading Property Damage Experts Are Here To Help

CONTACT NEW YORK’S HIGHEST RATED PUBLIC ADJUSTER IMMEDIATELY BY CALLING OUR OFFICE OR BY COMPLETING THE FORM.

CALL US FOR FREE